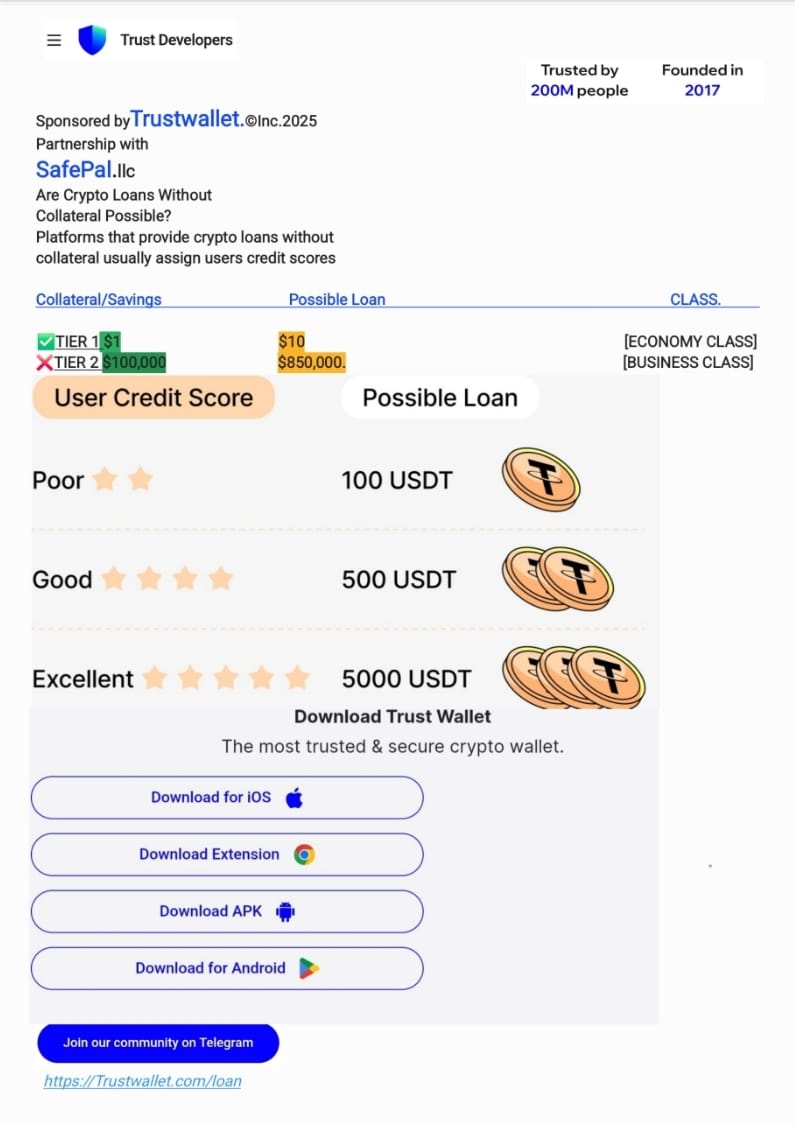

The article explains that a new type of crypto loan is emerging that doesn't require borrowers to lock up their digital assets as collateral. Instead of relying on over-collateralization, innovative platforms are now assigning users on-chain credit scores.

These scores analyze a user's blockchain history—such as transaction history, wallet age, and repayment behavior—to assess their creditworthiness, similar to how traditional banks use credit scores. This approach merges the sophistication of traditional finance with the efficiency of crypto, allowing asset-rich holders to access liquidity without selling their investments.

While challenges like volatility and data privacy remain, this shift towards trust-based lending using digital reputations is a significant step toward a more mature and accessible crypto financial system.

Loading comments...